Focus on the DPU, not the yield

When borrowing costs are high, income generating vehicles like bonds and Real Estate Investment Trusts (REITs) trade at very attractive prices so as to compensate investors for taking on more risk than risk free instruments. This compensation is known as the equity risk premium. The higher the risk, the higher the premium (even higher still for risky Tech stocks).

Excluding returns from capital gain, usually bond and REITs investors look at the yield, i.e. the recurring cash flow of coupons or dividends, respectively over the price they pay. Since REITs take on debt to fund property purchases, they are even more sensitive to borrowing costs and thus trade at attractive prices now, thus pushing up the yield.

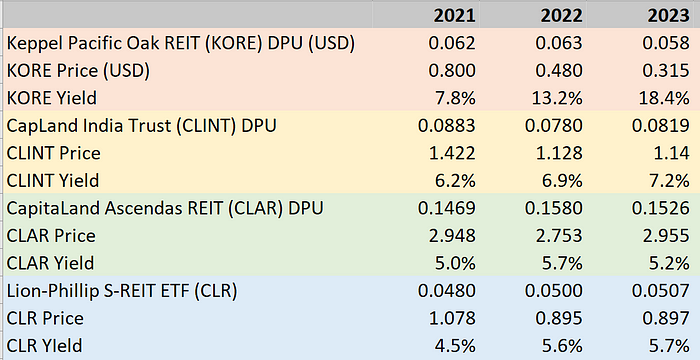

I extracted 3 REITs from my portfolio, one each from my own risk classifications. Risk in terms of dividend resiliency, not price. I used annual, full year figures for Dividend Per Unit (DPU) and closing prices for the year for ease of comparison.

Keppel Pacific Oak REIT (KORE) is one of the high risk REIT in my portfolio due mainly to the ongoing commercial office crisis in the United States. Price fell much faster than DPU, giving mouth watering yield that is actually far from sustainable.

Capitaland India Trust (CLINT) represents one of the medium risk REIT. The DPU is uncertain not because of any crisis but because of forex uncertainty. MAS maintains a long term policy to guide the appreciation of SGD for price stability and more so recently to combat imported inflation, thus depressing the translated DPU in SGD terms. I have quite a few such REITs in my portfolio under this category, Daiwa, Sassuer etc to name a few.

Next I have Capitaland Ascendas REIT (CLAR) amongst my anchor, safer bets that have exposures to both local and overseas properties. The DPU over the years are stable with corresponding stability in prices too.

A REIT exchange traded fund (ETF) like Lion-Philip S-REIT ETF (CLR) that holds a huge basket of REITs thus naturally provide the greatest stability in DPU.

The point I want to make is that price is hugely a reflection of market sentiment and yield along with that. Since I’m spending the cashflow that my investment brings, I’m solely focus on the DPU and make sure I keep accumulating enough units to grow my cashflow. I’m more interested to get enough variety of hens (units) to secure sufficient eggs (dividends). The DPU rather than price, or derived yield, is more important to me.

Ever since I pivoted toward income investing, I had thought that since I earn in SGD, it is better to get REITs with overseas exposure. The rationale was not to rely solely on Singapore’s economy for rental income. However, depreciating DPU after forex translation for REITs with overseas assets is challenging my strategy.

INVESTING, PERSONAL-FINANCE